Daily Comment – Demand for safe assets lingers

- Dollar, gold and US yields are on the rise

- US presidential election risks start to affect market sentiment

- Focus today on central bank speakers at the IMF annual meeting

- BRICS summit could generate headlines, particularly for the Middle East

US presidential election is firmly on the market's radar

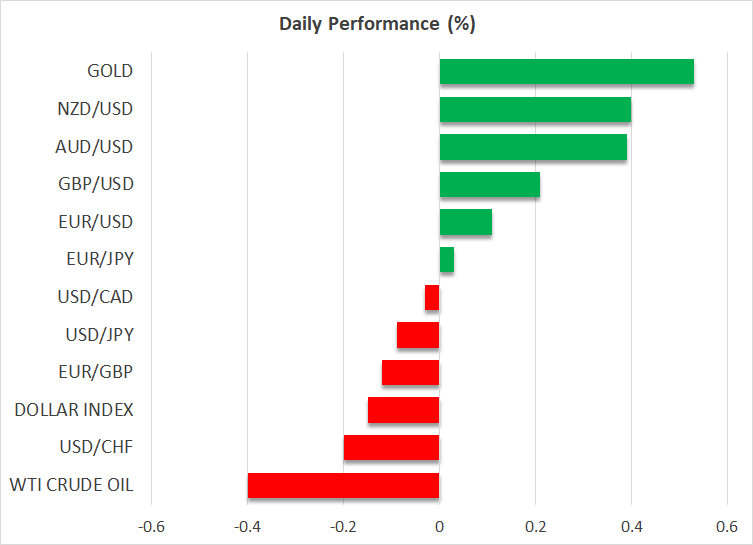

The US dollar continues to enjoy strong demand, outperforming its main counterparts. In particular, euro/dollar is trading at the lowest level since early August, and dollar/yen is hovering a tad below the 151 area. At the same time, gold is continuing its journey north, recording new all-time highs almost daily. Several reasons have been touted, with geopolitics, strong buying from Asian central banks and diversification away from the dollar being at the top of the list.

Euro/dollar is trading at the lowest level since early August, and dollar/yen is hovering a tad below the 151 area

In the meantime, the 10-year US Treasury yield has reached 4.2%, the highest yield since end-July, after climbing by more than 55bps from the mid-September trough. This move is counter-intuitive considering the fact that the Fed is preparing for another cut on November 7 and around 150bps of easing are currently priced in over the next 16 months.

Having said that, there is a common theme that could explain these movements. The US presidential election is acting as the rising tide that lifts all boats with investors seeking protection from a potentially negative market outcome. It is up to the market to decide if a Trump or a Harris win will produce a risk-off reaction, but market participants could also be preparing for a repeat of the 2000 presidential election, when the result was declared in courts almost one month after the election date.

Market participants could also be preparing for a repeat of the 2000 presidential election

Interestingly, stocks are also starting to feel the election pressure, with the S&P 500 index starting the week in the red and the Dow Jones index suffering the most during Monday’s session. Indicative of the current situation is the fact that the best performing stock in the Dow was Trump Media and Technology, potentially benefiting from the latest polls showing increased support for the former president.

Lighter calendar today, IMF and BRICS meetings under way

With most Fed speakers openly supporting the November rate cut, the focus today turns to the annual IMF meeting, which will take place in Washington, D.C. and will last until Saturday, October 26. A plethora of central bank members will be on the wires again today, mostly from the Fed, the ECB and the BoE, including ECB President Lagarde and BoE Governor Bailey.

A plethora of central bank members will be on the wires again today, mostly from the Fed, the ECB and the BoE.

Comments from BoE members will attract extra interest as the next BoE meeting, which will also feature the quarterly projections, is around the corner. The recent weaker CPI report has cemented the November rate cut despite the strong retail sales figures, with the market fully pricing a 25bps rate cut. However, the size of the rate cut could be affected by the Autumn budget published on October 30 with reports pointing to significant tax increases that will potentially dent the current momentum of the UK economy.

This week the 16th BRICS summit is also taking place in Russia. Five new members, including Iran and UAE, will officially join this bloc with Turkey, a NATO member, apparently considering membership. These summits do not tend to be market moving, but the world will pay extra attention to comments about the Middle East conflict and the rumoured announcement of a BRICS currency.

Related Assets

Latest News

Disclaimer: The XM Group entities provide execution-only service and access to our Online Trading Facility, permitting a person to view and/or use the content available on or via the website, is not intended to change or expand on this, nor does it change or expand on this. Such access and use are always subject to: (i) Terms and Conditions; (ii) Risk Warnings; and (iii) Full Disclaimer. Such content is therefore provided as no more than general information. Particularly, please be aware that the contents of our Online Trading Facility are neither a solicitation, nor an offer to enter any transactions on the financial markets. Trading on any financial market involves a significant level of risk to your capital.

All material published on our Online Trading Facility is intended for educational/informational purposes only, and does not contain – nor should it be considered as containing – financial, investment tax or trading advice and recommendations; or a record of our trading prices; or an offer of, or solicitation for, a transaction in any financial instruments; or unsolicited financial promotions to you.

Any third-party content, as well as content prepared by XM, such as: opinions, news, research, analyses, prices and other information or links to third-party sites contained on this website are provided on an “as-is” basis, as general market commentary, and do not constitute investment advice. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such, it would be considered as marketing communication under the relevant laws and regulations. Please ensure that you have read and understood our Notification on Non-Independent Investment. Research and Risk Warning concerning the foregoing information, which can be accessed here.